Existing can be very expensive. Therefor it is important to keep an eye on your personal financial status.

When I started living on my own, I noticed that my money went to a lot of new expenses. At the end of the month it all added up to a size that got quite large while my income was relatively small.

I didn’t know what my money was going to and where I could save some. So I decided to make an overview and started understanding my bigger and smaller expenses. I’ve tweaked the Income & Expense sheet a lot over the years and I can honestly say I’m very happy with where it is right now.

Click the button to download the Google sheet. I promise you won’t be disappointed!

Download Income & Expenses Google sheet – LagiLogi

NOTE: This is in no way the only way to track your finances and certain things in the sheet might not apply to you. Feel free to change, add or delete anything in the sheet to make it fit your needs and circumstances.

Let’s get into the works of the sheet.

The way the sheet works is with different tabs that are connected to the main overview tab. Down below you’ll find the list of all tabs, the tabs explained, descriptions for every column you’ll find within the tab – and screenshots to show you what the tabs look like.

These are the tabs:

Alright, let’s dive into them:

Overview tab

So the first tab is the big overview and contains a couple of elements.

– The detailed overview with the income(s) and expenses per month. Some of these expenses in this overview are linked to from the other tabs. This starts from row 16 in the screenshot.

– The global expenses overview showing the totals per different expense category – is the upper-right table.

– The global income and expense overview showing total income and expense per month, and the difference that shows if you saved or lost money that month – is the upper-left table.

Detailed overview explained

Income section: The income side is where you put the description of the income in the left column and the amount in the right column. The total of all different incomes is calculated at the bottom of the income section.

Expense section: This is where all expenses are located, differentiated in separate categories. At the bottom of the section is the total of all expenses combined for the month.

Fixed expenses: The fixed expenses that are every month more or less the same. All expenses, but the subscriptions, need to filled in manually.

- Rent: This is where you put your monthly rent, or mortgage payment.

- Utilities: The total monthly costs for gas, water, electricity and more if there is any.

- Phone: This is for your phone bill. This can also be added to subscriptions if you’d like that.

- Subscription: This is linked to from the Subscription tab. More information about this can be found below

- Monthly charity: If you give a specific amount to charities every month, you can put that here.

- Monthly debt pay-off: If you have a debt to pay off and you can do that every month, then you should. Put that amount here.

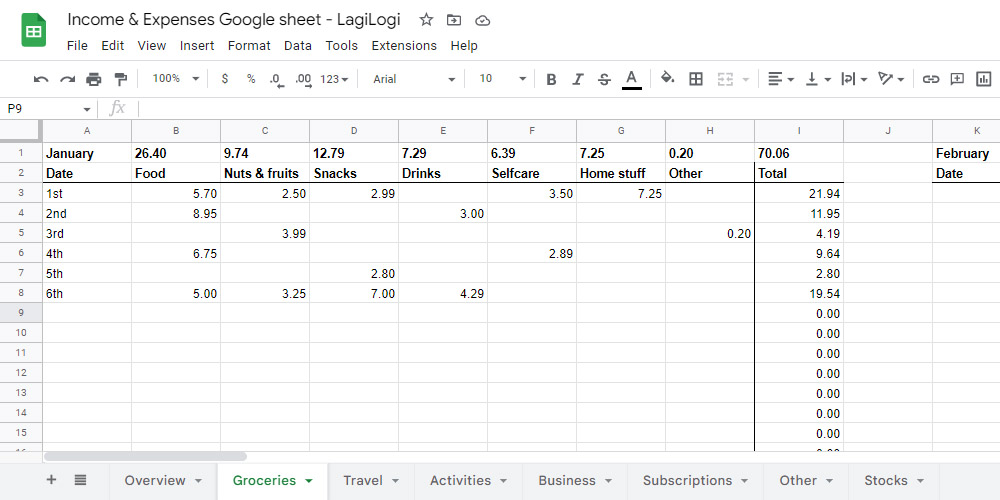

Groceries tab

The groceries tab is where I keep an overview of what I bought in separate categories and the date. This seems like overkill, but I can see exactly where my money is going and where I can save money (like snacks…).

Grocery overview explained

- Date: The date of when I bought groceries

- Food: This is for breakfast, lunch and dinner things, like bread, vegetables, meat, etc.

- Nuts & fruits: The more healthy category which I want to see some money spent on every month.

- Snacks: The unhealthy food category. Preferably the least of money goes here.

- Drinks: Bad drinks go here like sodas and alcoholic drinks.

- Selfcare: Things like toothbrushes, toothpaste, shampoo, deodorant, etc.

- Home stuff: Toiletpaper, cleanwipes, etc

- Other: Often only used for bags and such I buy to carry groceries.

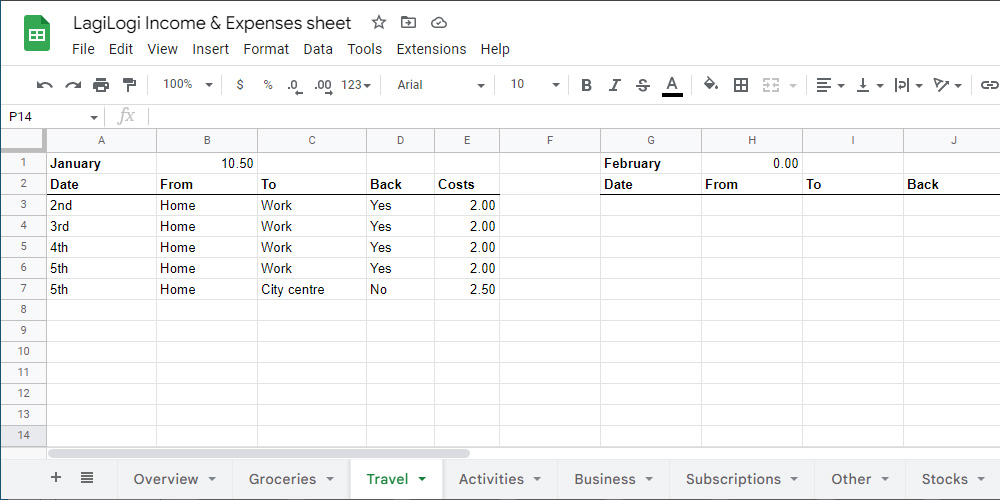

Travel tab

I made the travel tab specifically to see what my costs were when travelling with public transport. Later I started using it for car gas and every other expense that had to do with travelling

Travel overview explained

- Date: Date of travel.

- From: From where travelled, like home or randomstreet 123.

- To: Where travelled to, like work or a friend.

- Back: This gets answered either yes or no, depending on I took the same route back.

- Costs: The total costs of travelling somewhere (and back).

Activities tab

The activities tab is for all different activities like dinners, festivals, clubbing, going to the cinema, but also ordering food home.

Looking at this list at the end of the year gives you a timeline of all fun things you’ve done in the year!

Activity overview explained

- Date: Date of the activity.

- Costs: The total costs of the activity. Most of the time contains all different expenses that come with the activity like entrance ticket, food, etc.

- Description: The description of the activity.

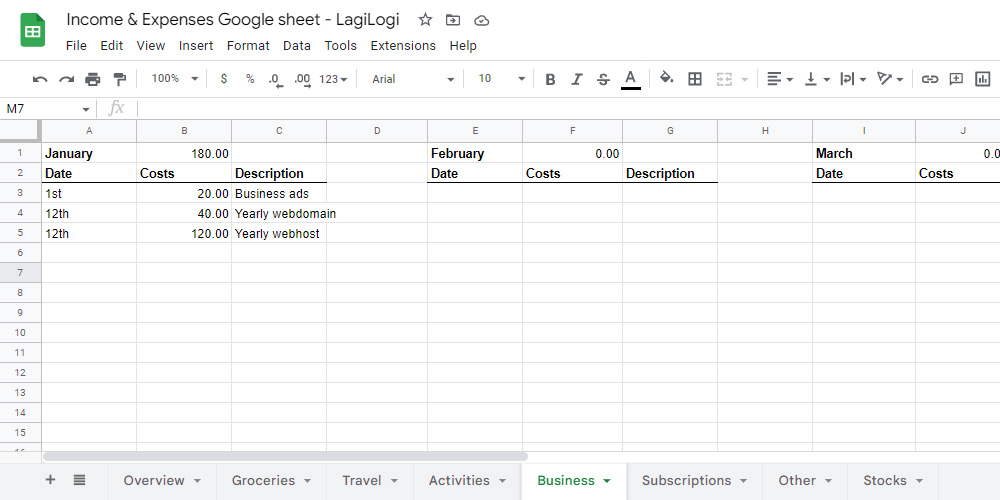

Business tab

The business tab is for money spent on side business related expenses like website domain & hosting, advertisements, freelancers, etc. It’s important to track because this is money you no longer have for personal use.

Business overview explained

- Date: Date of the transferring money from personal to business bank account.

- Costs: The amount of money transferred.

- Description: The description of why you transferred that money.

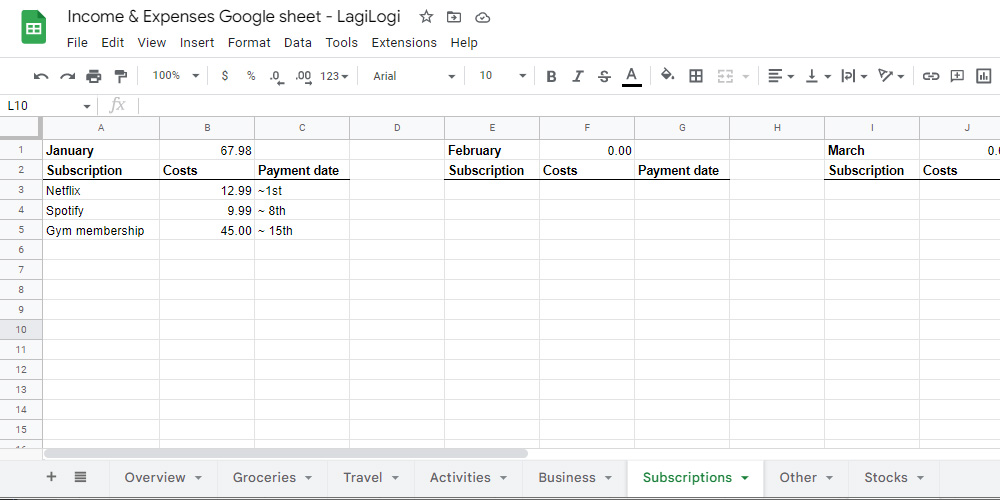

Subscriptions tab

The subscription tab is where all monthly subscriptions are shown and the total for the month. These are subscriptions like Netflix, game subscriptions, gym, etc.

Subscription overview explained

- Subscription: Shows what the subscription is for.

- Costs: The costs for the subscription.

- Due date: This is when the subscription is automatically paid approximately.

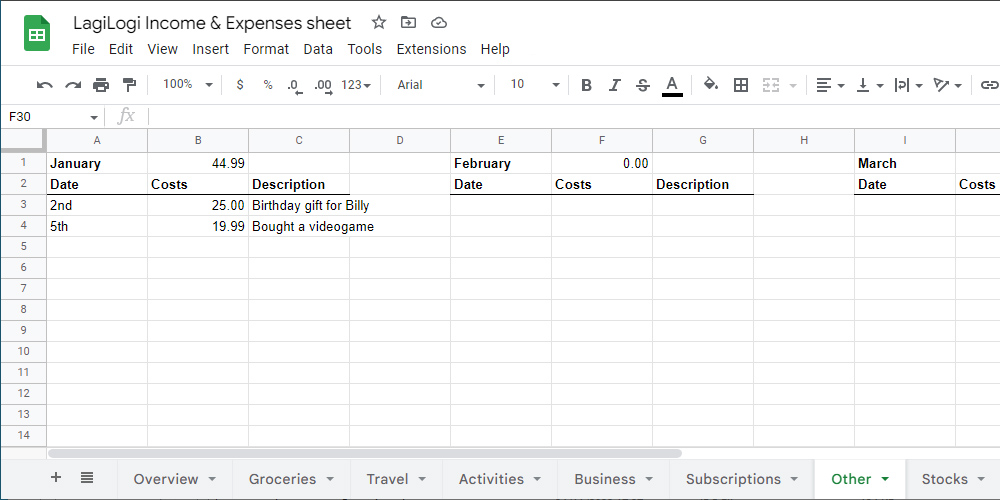

Other tab

The other tab is for everything else that does not fit any of the other tabs.

This can be things like birthday gifts, games, books, random things from the store, etc.

Other overview explained

- Date: The date of the purchase.

- Costs: The costs of the purchase.

- Description: What the purchase is.

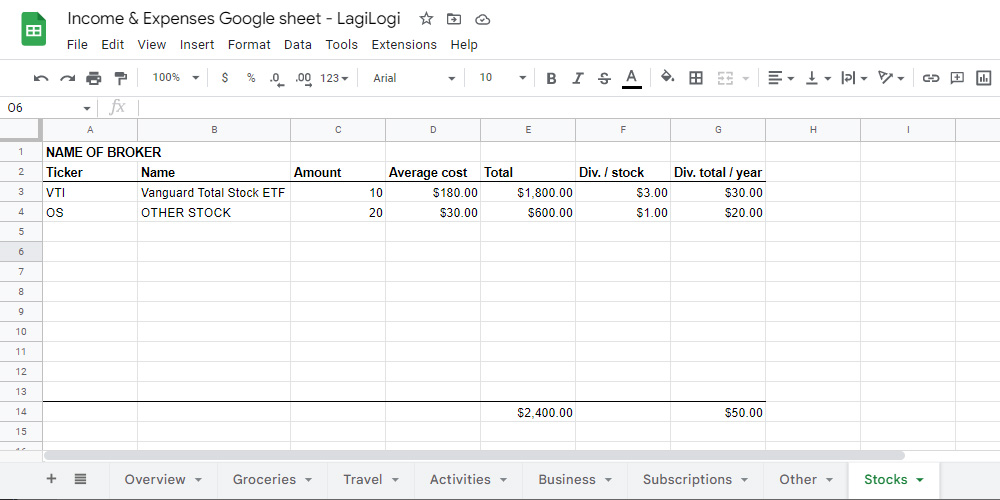

Stocks tab

The stocks tab is a list of all stocks and similar instruments I own.

Personally it mainly serves as an overview for the stocks and amounts I have and the dividends it pays me yearly.

Stocks overview explained

- Ticker: The ticker is the symbol of the asset owned.

- Name: Is the name of business.

- Amount: Is the amount of units owned of that asset.

- Average cost: Is the average price paid per unit.

- Total: Is the total amount of money invested in that asset.

- Div. / stock: Is the amount of dividends received per unit.

- Total div. / year: Is the total amount of dividends received per year for that asset

Conclusion

The Income and Expense sheet is very easy and intuitive. All you have to do is fill in the dates, amounts and sometimes a description and the sheet does the rest. Voila! You’ve got a nice overview of your personal financial status.

Fun fact: At the end of the year you’ll have a timeline of all the things you did in the year!

But! Now I’d love to hear from you!

Do you have another way of tracking your income and expenses? Or are you going to use the sheet?

Let me know in the comments!